It’s clearer than ever that newspapers must drive revenues from smaller local businesses (SMBs – short for small to medium businesses). The most popular way to measure progress with this is to drive the number of active accounts. Makes sense. More accounts has to equal more revenue, right?

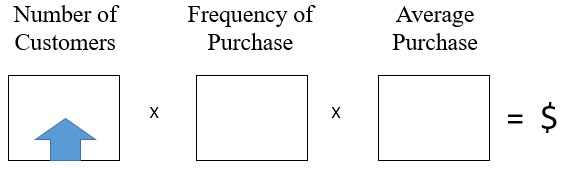

If you’ve pushed hard for increased actives, you’ve probably scratched your head wondering why it doesn’t make revenue go up. More often than not, it actually goes down. There are only three ways to grow a business. One is how many customers you have, so growing through increased acquisition looks like this:

Over the past year and a half, we’ve analyzed the details of every transaction at over 100 newspapers. Every sale over a 12 month period: advertiser name, rep, product, revenue and date. We create a series of reports designed to drill deeper into the drivers of revenue growth. How long are the new accounts sticking around? What do they buy? Do some products seem to stick better than others? Are some reps better at retaining clients than others?

Here’s what we saw after analyzing the first 40 or 50 papers:

We see a very clear correlation between increased actives and a drop in the overall value of each new account. When actives jump, sale size AND frequency drop enough to more than offset the value of the new actives. In fact, the harder you push, the more this accelerates. In a future blog post, I’ll share some pretty startling specifics on just how few new accounts are still around after just 30 or 60 days.

Acquiring new customers is great, but real growth will only come from retaining them, right? It’s the markets way of telling you that what you’re providing them is producing the results they were hoping for. The value of the efforts expended by a rep in prospecting and selling a new account can rarely be recouped from an ad or two. Compare all that time spent prospecting to the amount of time it takes to service an ongoing, satisfied client. Your sales reps time is the most precious finite asset, and it’s going down the drain every time a new client quickly churns.

It’s not at all uncommon for a rep to get as much as 90% of their revenue from 10% of their accounts, while the other 90% of the accounts they touch in a year are a revolving door of ‘acquisitions’ that typically spend less than $1,000 before leaving. This is true at both the smallest and the largest papers we’ve analyzed.

We’ve worked with many papers that decried a year or two ago that they really only wanted to work with prospects spending a minimum amount in a year. They were aware a high percentage of clients were spending very little and wanted to change that. $1,000 is the most common minimum target, but we’ve seen $2,000 or more. One recent client, a very large property, placed the minimum target at $2,000 two years ago.

Over the past 12 months, 45% of the businesses they served spent less than $1,000. 54% less than the $2,000 minimum. 31% ran one time, 45% ran twice in 12 months. This is not an outlier, quite the opposite. These numbers are about average and they vary much less than you would think they would between big markets and smaller ones.

So, what’s the problem and what’s the solution? Over the next several weeks, I’m going to share the main causes and what you can do about them. Some of that will be posts here on my blog. More of it will be emails to my list. (Sign up below.) And I’ll be doing a webinar in a few weeks that will show not only the analysis, but some steps you can take to retain a lot more clients. Again, the invitation for the webinar will be sent via email, so sign up below to be sure you get that invitation. I promise you I’ll make you think about parts of the sales process differently than before. (For example: your needs assessment may actually be part of the problem.) And it’ll be content you can use, not a sales pitch.